The Evidence Ledger

GAO Report Reveals Staggering Government Fraud Losses

GAO Report Reveals Staggering Government Fraud Losses

In a first-of-its-kind report, the Government Accountability Office (GAO) estimated that the U.S. government loses between $233 billion and $521 billion annually to fraud. That totals 3-7% of federal spending.

The GAO undertook the report because no reliable fraud loss estimates existed. The agency emphasized the inherent limitations in precisely quantifying fraud, including a lack of data availability, differing definitions and the crime's deceptive nature. The report's calculations are an overall government projection and do not include local or state-level fraud. The figures cannot be used to estimate losses in a specific agency or program or to predict future fraud.

However, the GAO asserted that these estimates illuminate opportunities to improve risk management by allowing government leaders to define the problem's scope, prioritize oversight efforts and demonstrate the return on investment of risk management activities. This report underscores the pervasive nature of fraud.

Estimating fraud losses

The GAO used a well-established probabilistic method to reach its estimates. The agency gathered data for fiscal year 2018 through 2022 from three sources:

- Investigative data, including fraud prosecutions.

- The Office of Inspector General (OIG) semiannual report.

- Confirmed fraud data reported to the Office of Management and Budget (OMB).

It also interviewed officials from 12 selected agencies, representing about 90% of all government obligations during 2018-2022. The GAO organized this data into three distinct fraud categories — adjudicated fraud, detected potential fraud and undetected potential fraud — and used a Monte Carlo simulation model to account for the inherent uncertainties and data limitations. The calculation resulted in an estimate of $233 billion to $521 billion, reflecting the complex and varied fraud risk environments across different federal programs and agencies.

Recommended executive actions

The report resulted in three recommendations to improve data availability for more granular fraud estimates.

The GAO urged the OMB to collaborate with the Council of the Inspectors General on Integrity and Efficiency (CIGIE) to develop guidance on collecting OIG data to support fraud estimation, including establishing consistent data elements and terminology for use across OIGs.

The GAO also recommended the OMB gather input from executive branch agencies to standardize fraud measurement and reporting across agencies.

In the final recommendation, the GAO asked the Secretary of the Treasury, in consultation with the OMB, to launch an initiative to assess and implement strategies for more comprehensive government fraud estimation to support risk management. This effort should leverage data analytics and initially prioritize program areas at the highest risk of fraud.

The Department of the Treasury concurred with the third recommendation, and the OMB generally agreed with the first two recommendations and indicated it is working with CIGIE to determine the next steps.

Implications for financial investigations

Given the huge fraud totals found in this report, forensic accountants and financial investigators cannot hope to keep up with scammers when using traditional data preparation and analysis approaches. Limited resources force many agencies to focus on the most obvious and least burdensome fraud cases. Each investigation requires significant time, generating a long backlog. To significantly reduce the staggering fraud losses, government agencies need the capacity to conduct more investigations more quickly.

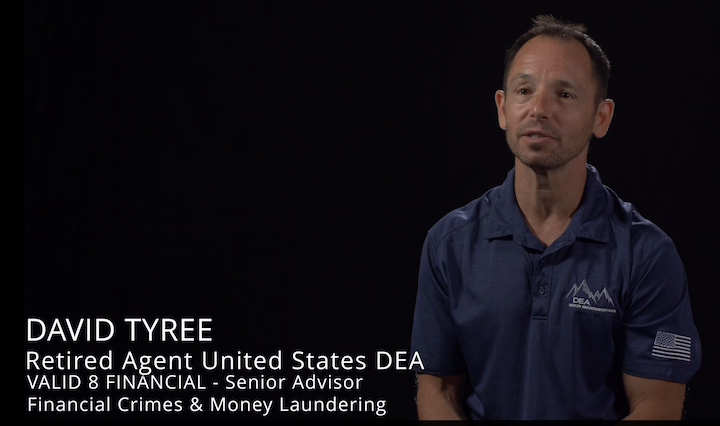

Verified financial intelligence (VFI) software will be critical to expanding the volume and complexity of fraud investigations. Valid8's platform generates fully verified financial evidence within hours rather than weeks. The automated process reduces workloads and accelerates time to insight. Investigators and accountants can spend time following the money instead of manually reconciling data.

The resulting evidence is more complete and reliable than manual processes, empowering agencies to prosecute — and win — more cases. Valid8's visualization tools create a clear picture of money flow, helping to establish the narrative and present the case to stakeholders, judges and juries.

The GAO's recommendations provide a roadmap for improving fraud estimation and risk management across the federal government. Enhanced visibility into the scale and targets of fraud empowers agencies to strategically allocate resources and invest in tools to catch and prosecute scammers. By embracing solutions like VFI, investigators can work smarter and faster to recover losses, hold fraudsters accountable and protect taxpayer funds from abuse.