Prepare Evidence in Hours, not Weeks

Valid8 is the only cloud-based Verified Financial Intelligence (VFI) platform designed by forensic accountants who leverage advanced AI. Purpose-built to help teams trace the flow of funds quickly and accurately, Valid8 gets you to analysis in less time and with more confidence.

Verified Financial Intelligence is Courtroom-Ready Evidence

OCR or Manual Data Entry

Trace the flow of funds in a single afternoon

OCR or Manual Data Entry

Even when you’re using OCR, manual clean up and analysis can take weeks to months

Get independent verification of all extracted financial data

OCR or Manual Data Entry

Manual clean up processes introduce an element of risk due to human error

Review and analyze 60% more, using the same staff

OCR or Manual Data Entry

Larger projects often trigger the need for additional resources

Compress Time to Opinion.

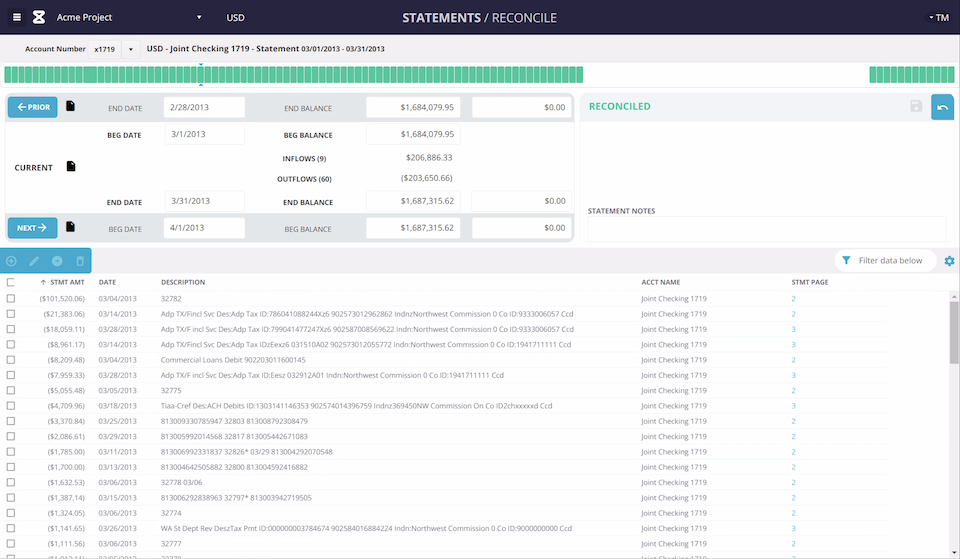

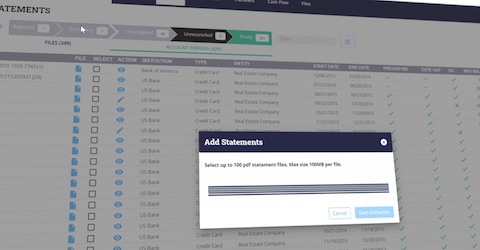

Upload bank statements, check and deposit slip images, accounting system extracts, and transaction lists to Valid8 and get fully verified financial evidence within hours. See why Valid8’s Verified Financial Intelligence (VFI) platform is exponentially faster than OCR solutions that require manual clean up.

Deliver Higher Accuracy.

Valid8’s VFI platform enables you to prepare evidence based on 100% of the financial data. Base your professional opinion on undisputed fact. No more gaps, no more sampling, just clean data extracted from the entire financial history.

Increase Output Without Increasing Headcount.

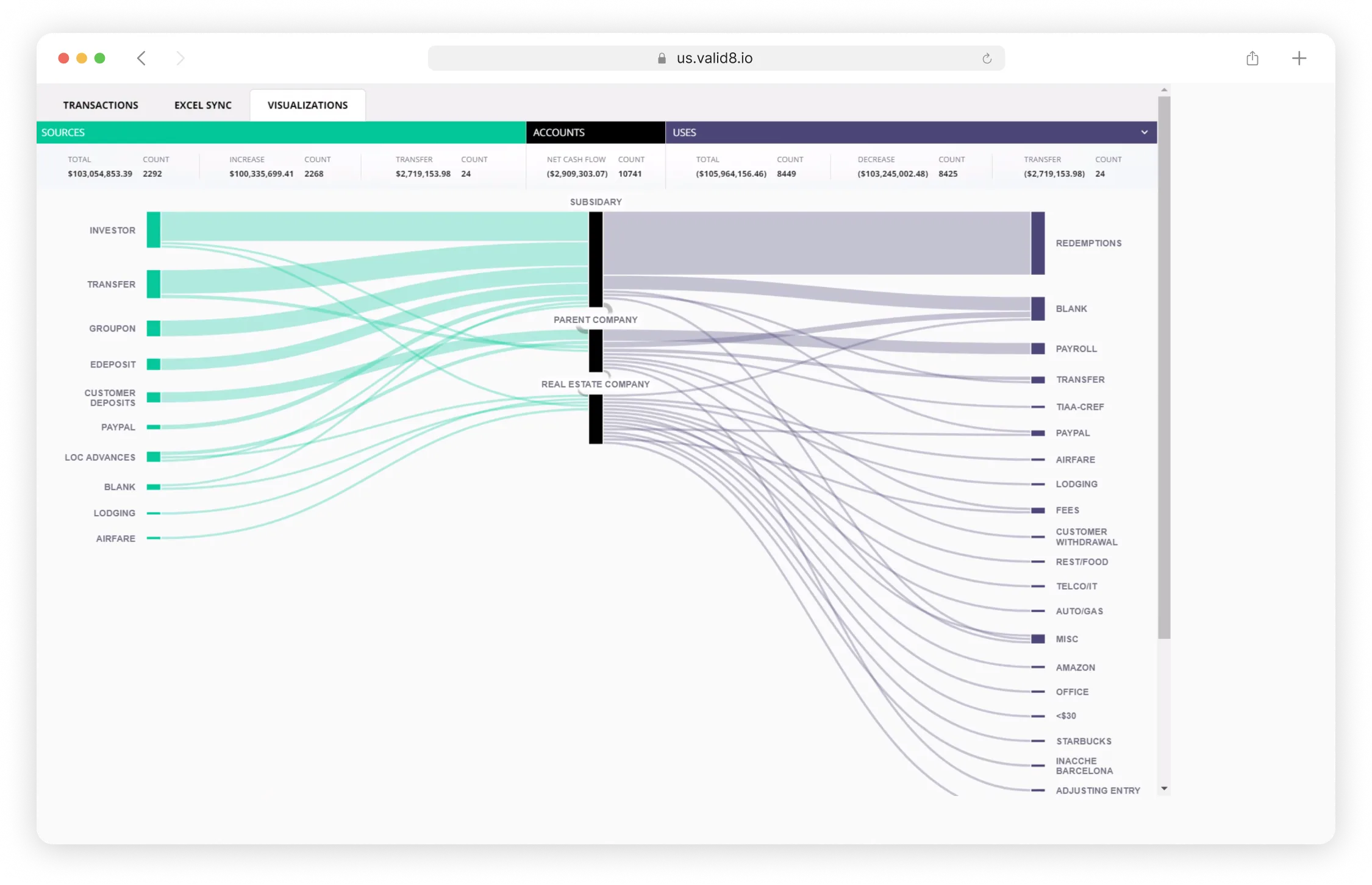

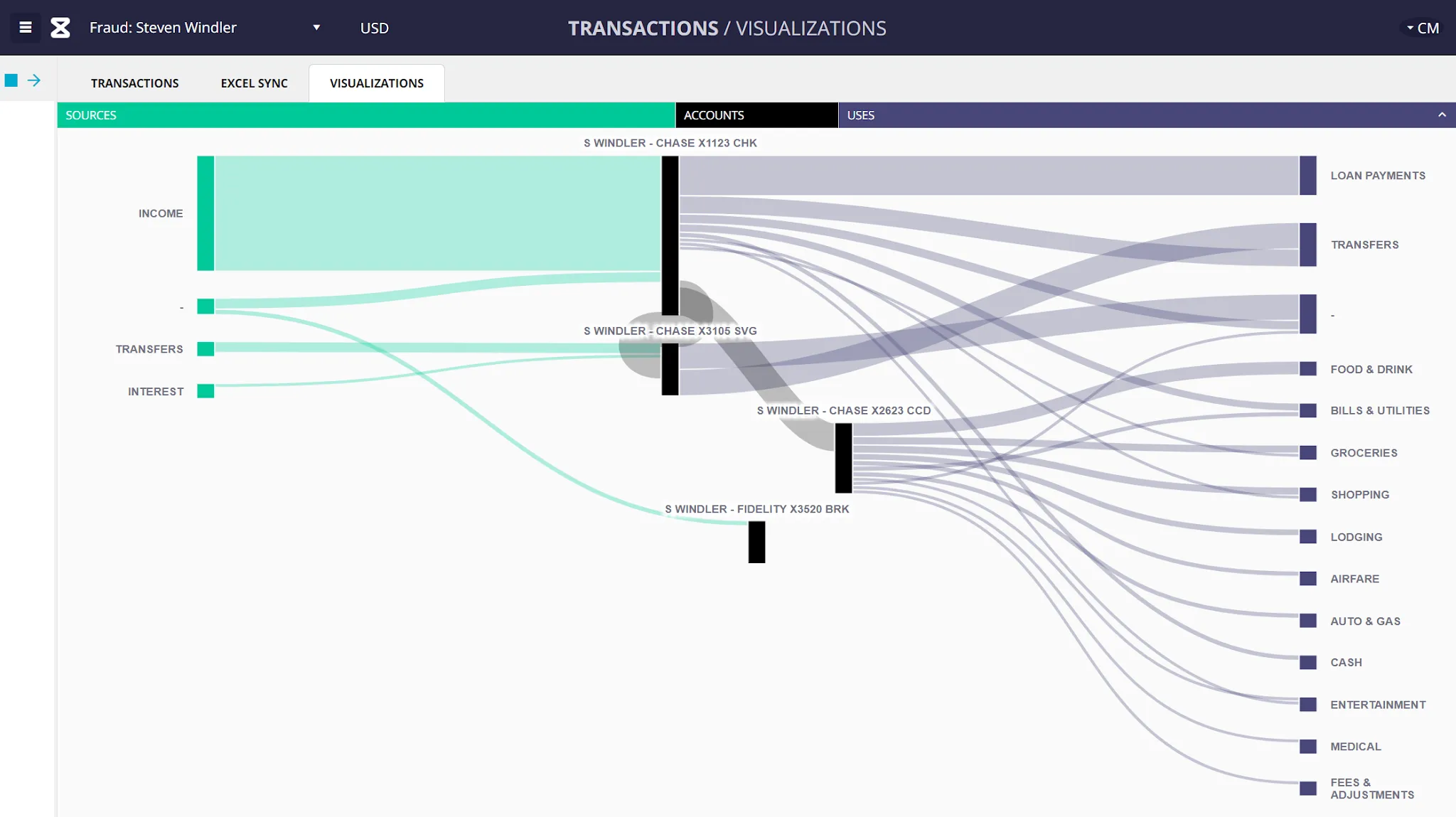

Tracing the complex flow of funds is time consuming and expensive. Even when using the latest OCR software, this key step takes a ton of your team’s time and can cost you in missed opportunities. Valid8’s VFI platform leverages powerful algorithms and AI to increase output and automatically turn large data sets into a visual narrative, making it easier to explain supporting evidence to prosecutors or other key stakeholders.

Attorneys, Forensic Accountants, Auditors, and Investigators Make their Case with Valid8

Accounting

Your employees didn’t spend years on advanced education to spend all their time using OCR software to parse data from bank statements, downloading it into Excel and then manually cross checking. Valid8 automates months of mind-numbing tasks into a single afternoon and verifies 100% of your extracted accounting data so you can move into analysis with confidence.

Whether your firm focuses on advisory, tax, or forensics, now you can get people into higher value tasks sooner.

“Nobody wants to be confined to sitting and typing on a 10-key for hours on end, days on end, weeks on end — you're going to burn out. Valid8 changes everything. It's utilizing technology in a way that so many people in my generation consider an everyday piece of our lives. It's a way for us to actually get to do the exciting stuff, the work, and feel like all that time we spent in the library was worth it. I never want to use anything but Valid8.”

Jess Gilmore

Legal

With Valid8 you can develop your strategy sooner, confident that you’ve extracted irrefutable evidence. Verified Financial Intelligence arms you with the truth. Powerful and accurate, Valid8’s VFI software keeps you one step ahead of opposing counsel.

Government

Instead of needing months to review and analyze, you’ll get evidence prepared in hours. Once you experience Valid8’s powerful Verified Financial Intelligence software, you won’t tolerate the inefficiencies of the old, manual ways.

“Any attorney general office that uses Valid8 for a Medicaid fraud investigation would never go back. It would be like going back to manual typewriters from desktop computers. It's impossible to conceive.”

Rob McKenna

Free resources for financial investigators, lawyers, and forensic accounting professionals

See More Resources

Valid8 forensic accounting software overview

Disputes and Investigations: Best Practices Guide